Cayman Sandwich

What is the Cayman Sandwich?

(versión en español)

The Cayman Islands have become the culinary capital of the Caribbean, known for innovative dishes mixed with traditional flavors. But its most famous concoction isn’t found on a restaurant menu.

No, the Cayman Sandwich isn’t coco bread with jerk chicken and scotch bonnet peppers, the Cayman Sandwich is a game-changer for attracting international investment and scaling businesses efficiently. Instead, it’s a strategic corporate structure designed to help start-ups, SMEs, and entrepreneurs in Latin America attract international investors and scale their businesses efficiently.

Why Latin America is Hungry for the Cayman Sandwich?

Latin America (LatAm) is one of the fastest-growing regions for venture capital (VC) and private equity (PE). In 2022 alone, the region attracted $7.8 billion in VC investments across over a thousand deals. Yet, for promoters of these investments, the real magic happens when they introduce investors to the Cayman

Sandwich.

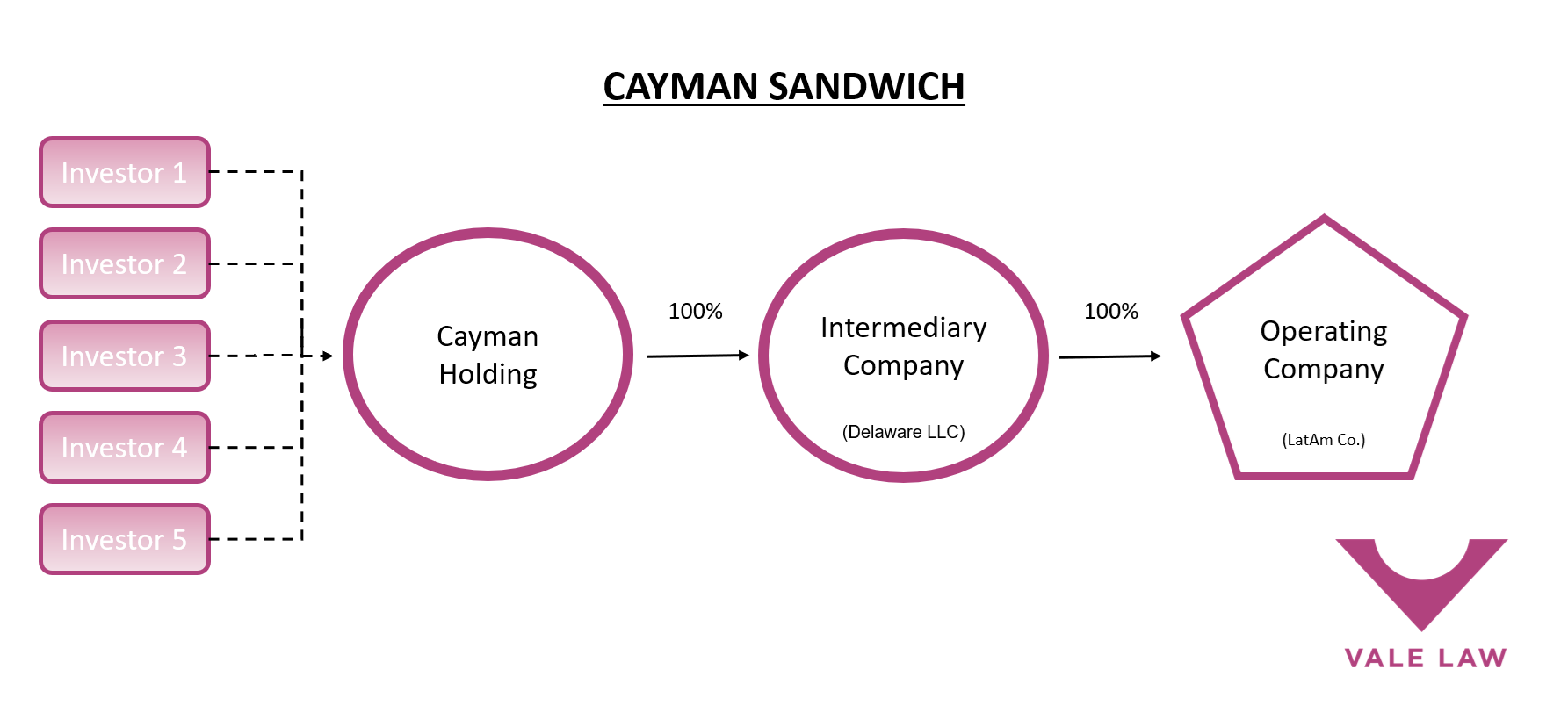

This structure streamlines investment by allowing both local and international investors to pool funds in a Cayman holding company, which then owns a Delaware LLC, serving as the sole shareholder of the Latin American operating company. This approach offers flexibility, robust legal systems, and tax efficiency, makingit a favorite among VCs, PEs, and entrepreneurs alike. In this article, we’ll dive deeper into the Cayman Sandwich, exploring its advantages, challenges, regulatory considerations, and why it remains a go-to strategy for scaling businesses in LatAm.

Why International Investors Love the Cayman Sandwich?

When it comes to venture capital in Latin America, international investors are key drivers of growth. In the past decade, the number of global General Partners (GPs) (the decision-makers behind VC funds) has surged, along with Limited Partners (LPs) who supply the majority of the capital. Today, nearly half of all venture deals in the region feature at least one international investor.

But for international investors, trust in the legal system is non-negotiable. Investing directly in local jurisdictions, can be shaky and raises red flags for instance, in the World Bank’s Ease of Doing Business rankings, Mexico ranks 54th for protecting minority investors, while Brazil stands at 109th, and Colombia at 65th. The Cayman Sandwich offers a solution. By placing investments at the Cayman holding company level, investors enjoy the security of a well-established legal system, robust protections, and the efficiency that comes with an internationally respected jurisdiction.This isn’t just about structuring investments; it’s about giving investors the confidence they need to put their capital to work in LatAm’s booming markets.

How Does the Cayman Sandwich Work?

As we’ve stated before, the Cayman Sandwich is not something you’ll find on a Caribbean restaurant menu, but it’s just as layered and carefully crafted. It involves three key layers, each serving a specific purpose:

1. Cayman Islands Holding Company:

At the top of the structure sits the Cayman holding company. This is where local and international investors pool their funds. The Cayman Islands are known for their tax neutrality, strong legal framework, and investor-friendly regulations. For global investors, this layer offers a familiar and trusted jurisdiction, reducing concerns about legal uncertainties in Latin America.

2. Intermediary Company (Often a Delaware LLC):

Below the Cayman holding company is an intermediary company, frequently a Delaware LLC or another US-based entity. This layer adds flexibility and facilitates transactions, especially when dealing with US investors or preparing for an eventual exit strategy like a merger or acquisition. The intermediary company holds shares in the operating entity, acting as a bridge between the Cayman holding company and the Latin American business operations.

3. Latin American Operating Company (OpCo):

At the base of the sandwich is the Operating Company (OpCo) — the heart of the business. This is where all the real action happens: developing products, serving customers, and managing day-to-day operations in countries like Mexico, Brazil, or Colombia. Structuring ownership through the Cayman Sandwich helps protect investors from potential legal and systemic risks that can come with direct investment in these jurisdictions.

This three-layer design ensures that investments flow smoothly, risks are managed effectively, and everyone involved, from startups to international investors, feels secure and confident.

Why Choose the Cayman Islands?

When it comes to structuring investments, the Cayman Islands are like a finely tuned instrument, striking the right chord with startups, SMEs, and investors alike. But why do so many choose the Cayman layer in the Cayman Sandwich? The answer lies in the unique advantages the jurisdiction offers:

1. Tax Neutrality:

One of the Cayman Islands’ most attractive features is its tax-neutral environment. There are no corporate income taxes, capital gains taxes, or withholding taxes on profits generated outside the jurisdiction. This ensures that investors and businesses avoid double taxation and can maximize their returns.

2. Legal Flexibility:

Cayman’s legal system is based on English common law and offers a high degree of flexibility. Investors benefit from clear, modern legislation and the ability to draft customized operating agreements or articles of association that suit their specific needs.

3. Investor-Friendly Jurisdiction:

The Cayman Islands are known for their robust legal protections and reputable courts, including the specialist Financial Services Division of the Grand Court. This gives investors confidence that their rights will be protected. The jurisdiction’s commitment to transparency and good governance further enhances its credibility on the global stage.

In short, the Cayman layer provides a combination of flexibility, security, and efficiency that few jurisdictions can match. It’s no wonder that when international investors look for a safe and streamlined path to Latin American opportunities, the Cayman Islands consistently top the list.

A World of Flexible Structures

The Cayman Islands are like a Swiss Army knife for investors, versatile, reliable, and full of useful tools. When it comes to the Cayman Sandwich, this jurisdiction offers a buffet of legal structures to suit different needs and strategies. Let’s explore the main options and why they make the Cayman layer so appealing.

1. The Exempted Company

Think of the Exempted Company as the classic choice for the top layer of the Cayman Sandwich. It’s sleek, familiar, and trusted by international investors. This structure offers limited liability, tax neutrality, and a straightforward way to issue shares. If you’re looking to create a solid holding company that keeps things

clean and efficient, this is your go-to.

2. The Cayman LLC

For those who love a bit more flexibility, the Limited Liability Company (LLC) is your friend. It blends the best of partnerships and corporations and gives you the freedom to write your own rules through an Operating Agreement. It’s especially handy as it is very similar to the Delaware LLC. No need for shares, just pure contractual flexibility through its operating agreement, perfect for keeping things nimble and efficient.

3. The Exempted Limited Partnership (ELP)

If you’re in the private equity or venture capital world, the Exempted Limited Partnership (ELP) is a familiar and powerful tool. It’s all about balancing control and protection: the general partner takes charge, while the limited partners (often investors) get the protection of limited liability. The ELP keeps things confidential, tax-neutral, and flexible, it’s a great fit for funds looking to invest seamlessly in Latin America.

4. The Foundation Company

Need something a little different? Enter the Foundation Company, a hybrid that combines the structure of a company with the flexibility of a trust. It can have no shareholders, just a purpose and a lot of potential. This makes it ideal for philanthropic goals, succession planning, or protecting assets while keeping a corporate structure. It’s like having a company that doesn’t need to worry about shareholders, a rare and useful tool.

5. The Trust

For those focused on wealth preservation and estate planning, a Trust is like a safety deposit box for your assets. You hand over control to a trustee, who manages everything for the benefit of your chosen beneficiaries. Trusts offer confidentiality, flexibility, and robust protection. In a Cayman Sandwich, it can be the perfect complement to other structures, ensuring your assets are safeguarded for the long run.

Navigating the Regulatory Waters

While the Cayman Islands offer tremendous flexibility and tax neutrality, there are a few important regulations to consider such as the Beneficial Ownership Transparency Act. This law ensures that certain entities disclose their beneficial owners, enhancing transparency while maintaining the Caymans' reputation as a trusted jurisdiction.

Then there’s the International Tax Co-operation (Economic Substance) Act, commonly known as the Economic Substance Regime. If your Cayman entity conducts specific activities, like being a holding company or managing intellectual property, you’ll need to demonstrate that you have an adequate presence in the Cayman Islands. This means showing some real activity: a local office, decision-makers, or employees on the ground.

These regulations, along with Anti-Money Laundering (AML) regulations, help keep the Cayman Islands a safe and reputable place for global investments.

Exit Strategies

As we’ve discussed throughout this article, the Cayman Sandwich is the most efficient structure for start-ups, SMEs, and entrepreneurs seeking international investors. But what’s the ultimate goal for these investors? A successful exit, whether through a merger, acquisition, or IPO. The Cayman structure is designed to make this process smoother, faster, and more appealing to international stakeholders.

In cross-border mergers and acquisitions, the Cayman Islands’ combination of legal clarity and investor protections reduces friction. International acquirers feel more comfortable dealing with a jurisdiction they know and trust, rather than wading through the complexities of local Latin American laws. This familiarity means quicker negotiations and greater confidence for all parties involved.

When it comes to IPOs, the Cayman structure shines even brighter. Major exchanges like NASDAQ and the NYSE have seen a growing wave of Cayman-incorporated companies. As of November 2024, there were over 400 Cayman entities listed on these U.S. exchanges, representing more than 30% of all non-U.S. listed entities. This isn’t just a trend, it’s proof that the Cayman structure offers the flexibility, tax neutrality, and investor confidence that make pre-IPO restructuring seamless

.

In short, the Cayman structure isn’t just about growing a business, it’s about ensuring that when the time comes to exit, the door is wide open, the path is clear, and the rewards are ready to be reaped.

Conclusion

The Cayman Sandwich is a powerful structure for attracting international investors, simplifying cross-border transactions, and setting up smooth exit strategies. But like any strategic tool, it comes with risks that need careful management.

Potential pitfalls include regulatory scrutiny, particularly around beneficial ownership transparency and economic substance requirements. Failing to comply with these can lead to penalties, reputational damage, or even invalidated structures. Additionally, the complexity of managing entities across multiple jurisdictions can create operational challenges if not properly documented and maintained.

Another key consideration is the flow of funding and repatriation of profits. Ensuring that money moves smoothly between jurisdictions requires careful attention to currency controls, tax treaties, and local regulations. Without proper planning, you could face delays, unexpected taxes, or restrictions on getting profits back to investors.

Ensuring clear, robust documentation and ongoing compliance is critical to mitigating these risks. If you’re a promoter, director, entrepreneur, or manager of an emerging business in LatAm and you’re wondering how the Cayman Sandwich might work for you, or whether it aligns with your business needs, don’t hesitate to reach out to your legal counsel at Vale Law. Let Vale Law help you navigate the Cayman Sandwich and turn your business goals into a reality.

Shelley Do Vale: shelley.vale@valelaw.ky

Santiago Mtnez-Carvajal: sc@valelaw.ky